Few things are worse than helping homebuyers find their perfect home, then realizing that they don’t qualify for a mortgage that will help them move forward with the purchase.

Through our partnerships with realtors, we’ve discovered some common questions and misconceptions that first-time homebuyers have when they begin their home search. This article is a comprehensive guide to homeownership for first-time buyers. It’s full of information that will prepare you and your buyers for this exciting journey.

Hopefully, it’ll also help them avoid any disappointment in their home search and make it possible for them to confidently move forward with purchasing their dream home.

Renting vs. Buying

Monthly mortgage payments are often lower than rent payments, so some people dive into the home buying process before they really understand what they’re getting into.

The first step in your buyer’s journey should really be assessing whether purchasing a home is even the right decision for them. Some things they should consider are:

- Whether their job would require them to relocate in the near future.

- Whether they like the area enough to set down roots for a few years.

- If they need outdoor space for kids, pets, or cookouts with friends.

- Whether their income is stable enough to support a mortgage (and other costs associated with owning a home).

- Their personal goals — are they interested in investing their money in real estate now, or would they rather have the financial flexibility to travel, attend social events, etc.

- Their desire to maintain a home, versus letting a property manager take care of it.

People who prefer flexibility may not be ready to buy. However, homeownership is a great financial investment for people who have a stable income and want to set down roots.

See more pros and cons of renting vs. buying →

Can They Afford a Home?

Once your buyer has weighed the pros and cons of renting versus buying and decided that buying is their best option, it’s time to assess whether they can afford the cost of a home.

.png?width=800&name=Realtor%20Pillar%20(1).png)

They need to factor in costs beyond the mortgage payment, like utilities, HOA fees, yard maintenance costs, etc.

In addition to monthly costs, they need to save for the out-of-pocket costs they’ll pay at closing, including their:

- Down payment

- Closing costs

- Appraisal fee

- Taxes

- Homeowner’s insurance

Learn more about budgeting for the cost of a home →

Credit Score 101

One of the most common questions we get from buyers is, “How high does my credit score need to be?”

The short answers, it depends.

Buyers who are taking advantage of a government program will not need as high of a score as those who are applying for a conventional loan. Buyers should have a score of at least 580 for most government programs and a score of 620 or higher for conventional loans. However, higher scores will help buyers qualify for lower interest rates, no matter which type of loan they’re seeking.

If your client is worried about their score or wants to improve their score before applying for a mortgage, there are some simple steps they can take:

- Pay off outstanding debts, like credit cards or collections accounts

- Make sure they make all payments on time for several months before applying for their mortgage (and after!)

- Establish new, good credit — many young people simply don’t have much credit, so getting a credit card and paying it off each month can build a good credit history

- Check their credit report and correct any mistakes

If one of your buyers is worried about their credit score, we’re happy to take a look with them and offer them guidance about how to raise their score in a free, no-obligation credit coaching session.

Learn more about how credit scores affect mortgage terms →

Getting Prequalified

One of the best pieces of advice you can offer to your clients is to get pre-qualified for a mortgage BEFORE they start shopping. It’s heartbreaking to fall in love with a home and later learn that you can’t afford it.

Prequalification helps buyers develop a comfortable, realistic home budget.

During a pre-qual, a lender will look at a buyer’s:

- Credit score

- Debt-to-income ratio

- Down payment

- Closing cash

Learn more about what lenders look at during prequalification →

How to Budget for Monthy Costs

First-time buyers are sometimes surprised that their monthly housing costs include more than just their mortgage. Some of the costs they should budget for are:

- Monthly mortgage payment

- Utilities (internet, gas, electrical, water, waste disposal, etc.)

- Homeowner’s Association fees (when applicable)

- Private mortgage insurance (PMI)

- Homeowner’s insurance premiums

- Home maintenance costs (we recommend setting aside at least 1% of the home’s value for annual maintenance)

- Yard maintenance (if hiring help)

Developing an accurate budget can help buyers avoid surprises and financial stress.

Your buyers can learn more about common monthly costs here →

How Long Does it Take to Buy a Home?

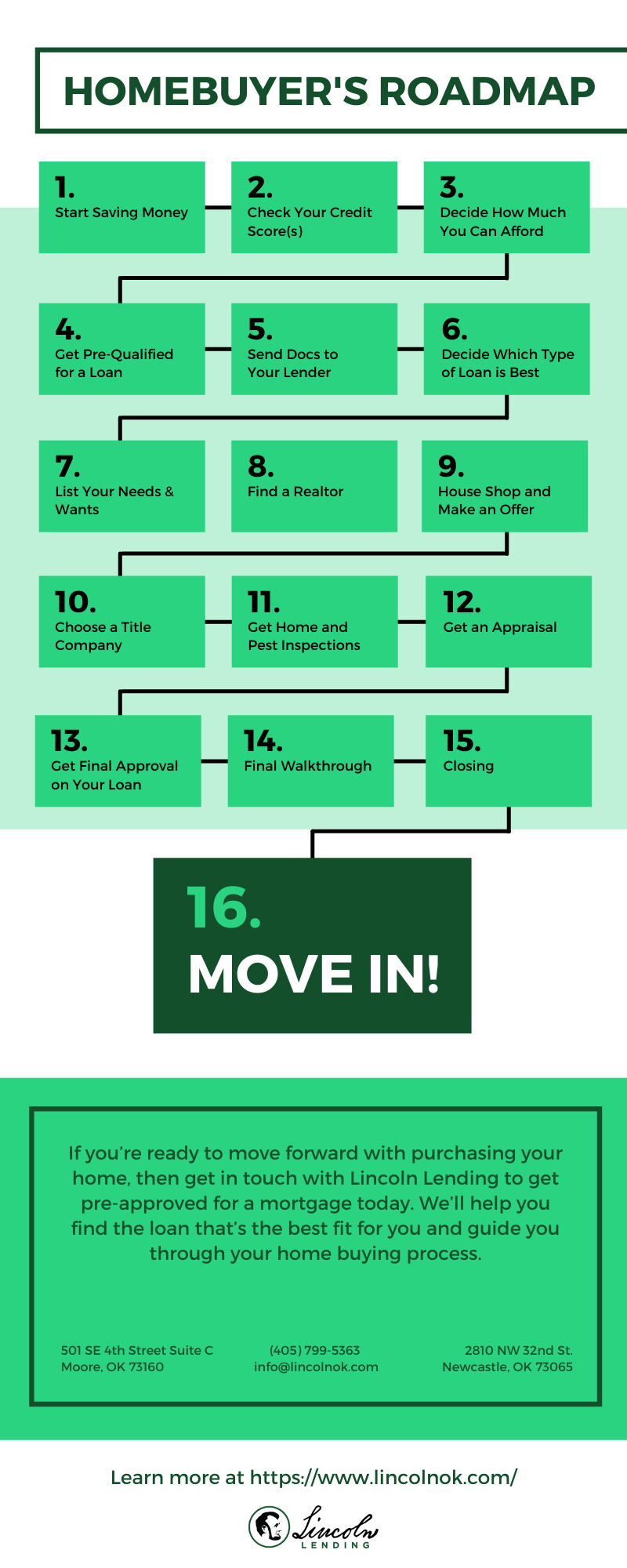

Buying a home is an exciting milestone, but it can also be stressful when buyers don’t know what to expect from the experience. Sometimes, laying out a roadmap of what steps to expect and how long the home buying process typically takes can remove some of the stress and help buyers focus on the excitement.

Typically, the mortgage process takes 45-60 days, but that’s after you find your dream home.

Also, spring and summer are the busiest times of year to buy a home, so sometimes there can be delays. The underwriters, appraisers, inspectors, and others involved in the process tend to have full schedules.

One way to make the process as efficient as possible is for your buyer to be responsive to lender requests for documents to avoid unnecessary delays.

It’s Never Too Early to Get Started

No matter what stage of the home buying journey your client is in, it’s never too early to start building a relationship with a lender. We love helping buyers set themselves up for financial success with their home investment! If they’re ready to get started, have them get in touch with us.